Difference between revisions of "Per Diem Rates (CONUS)"

| Line 1: | Line 1: | ||

| − | [[File:GSA Website Snapshot.jpg]] | + | [[File:GSA Website Snapshot.jpg]]==Summary== |

| − | + | ||

| − | ==Summary== | + | |

Per Diem is a ''latin term'' for ''"per day".'' CONUS, means the contiguous United States, which is the 48 adjoining U.S. States, plus the District of Columbia. | Per Diem is a ''latin term'' for ''"per day".'' CONUS, means the contiguous United States, which is the 48 adjoining U.S. States, plus the District of Columbia. | ||

Revision as of 14:28, 28 October 2013

==Summary==

Per Diem is a latin term for "per day". CONUS, means the contiguous United States, which is the 48 adjoining U.S. States, plus the District of Columbia.

==Summary==

Per Diem is a latin term for "per day". CONUS, means the contiguous United States, which is the 48 adjoining U.S. States, plus the District of Columbia.

Per Diem rates are amounts that are reimbursed to individuals for the costs of travel. Title 41 Code of Federal Regulations (CFR) implements the statutory requirements and Executive branch policies for civilian employees authorized to travel at government expense. There are two principal purposes for establishing per diem rates.

- 1. To interpret the statutory and policy requirements in a manner that balances the need to assure that official travel is conducted in a responsible manner while minimizing administrative costs,

- 2. To communicate the resulting policies in a clear manner.

US Federal contractors have 2 acceptable methods for reimbursing employees. Generally, they chose the per diem method, as the amounts allowed for reimbursement of daily expenses have been reviewed by the General Services Administration and determined to be reasonable. Generally contractors also use this method for State and Local governments. Generally, these government entities follow these guidelines, as the guidance assures reasonable charges, and reduced additional cost by the contractor and government for administrave and audit oversight. For Per Diem rates outside the United States, see, Per Diem Rates (OCONUS). For Per Diem rates in Hawaii, Puerto Rico, and Alaska, see....

Under the actual method, a person must keep their receipts and show proof on expenditure. Furthermore, when reimbursing the employee, a contractor must ensure:

- That the expenses are reasonable, and

- There are no expressely unallowable costs (ie alcohol) in those costs.

Because of the additional administrative burden under the actual method, most contractors prefer the per diem method. Under that method, a traveler does not have to show proof of expenditure, nor incur the expenses, just show that he/she traveled that day, and the purpose of travel. The additional administrative burden is not just on the contractor, but the federal government as well, analyzing costs to ensure the contractor properly segregated allowable and unallowable costs as well as reasonable costs. As such, the US Government also prefers the use of per diem cost reimbursement.

There are two different cost categories under the per diem method of reimbursement. They are:

- Lodging, and

- Meals and Incidentals

Contents |

Per Diem Resources

The following link, http://www.gsa.gov/graphics/ogp/FTR2011-07Complete.pdf, provides a 2004 brochure on the Federal Travel Regulations.

Lodging

Lodging costs are hotel/motel costs for travel where the traveler is on travel overnight.

Meals and Incidentals (MI&E)

Meals and Incidentals are costs for all other travel costs except lodging, and personal automobile costs. Travel days must be considered when reimbursing Meals and Incidental expenses. The first and last day of travel is calculated at 75%.

Additioanal Considerations

If a traveler is attending a conference, a business lunch or dinner, or any other function where a meal is provided, the traveler must not be reimbursed for that meal, and is required to deduct that portion of the daily M&IE attributable to that meal. The GSA provides breakdowns of the various components that make up the daily per diem allowance so that the appropriate costs (lack thereof) can be deducted from the travlers per diem claim. The location of that information is: http://www.gsa.gov/portal/content/101518

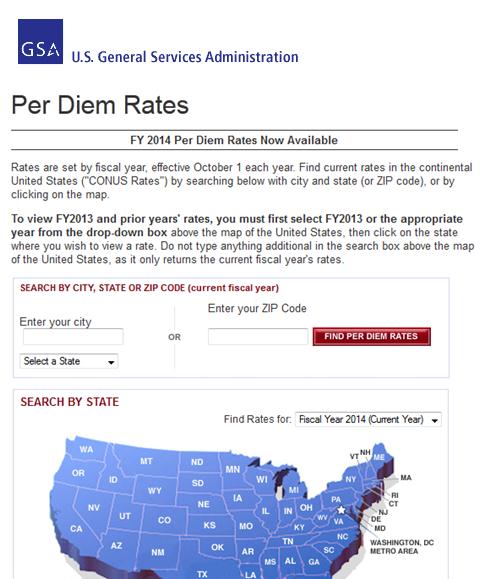

The page where Per Diem Rates can be found on the GSA site [[1]]

Privately Owned Vehicle (POV) Mileage Reimbursement Rates

In addition to Lodging and M&IE, the GSA also provides rates for reimbursement of Privately owned vehicles. These reimbursement rates may differ from the IRS rates. As of 4/17/2012. For additional discussion of this topic, please see, Privately Owned Vehicle/Mileage Reimbursement Costs.