Per Diem Rates (CONUS)

Contents |

Introduction

Per Diem is a latin term for "per day". CONUS, means the contiguous United States, which is the 48 adjoining U.S. States, plus the District of Columbia.

GSA establishes the per diem rates for the lower 48 Continental[1] United States (CONUS), which are the maximum allowances that federal employees are reimbursed for expenses incurred while on official travel. This sets the standard for all CONUS travel including individuals traveling for commercial contractors who perform work on US contracts.

Purpose

Title 41 Code of Federal Regulations (CFR) implements the statutory requirements and Executive branch policies for civilian employees authorized to travel at government expense. There are two principal purposes for establishing per diem rates.

- 1. To interpret the statutory and policy requirements in a manner that balances the need to assure that official travel is conducted in a responsible manner while minimizing administrative costs,

- 2. To communicate the resulting policies in a clear manner.

Methods for Reimbursing Travel Costs

US Federal contractors have 2 acceptable methods for reimbursing employees, per diem method, or actual costs.

Per Diem Method

They may chose the per diem method, as the amounts allowed for reimbursement of daily expenses have been reviewed by the General Services Administration and determined to be reasonable. The CONUS per diem rate for an area is actually three allowances: the lodging allowance, the meals allowance and the incidental expense allowance.

Lodging Allowance

Meals Allowance

Incidental Expense Allowance

What's Not Covered

Taxes [2]

Lodging taxes paid by you are reimbursable as a miscellaneous travel expense limited to the taxes on reimbursable lodging costs. For example, if the maximum lodging rate is $100 per night, and a traveler elects to stay at a hotel that costs $200 per night, you can only claim the amount of taxes on $100, which is the maximum authorized lodging amount.

Actual Cost Method

Under the actual method, a person must keep their receipts and show proof on expenditure. Furthermore, when reimbursing the employee, a contractor must ensure:

- That the expenses are reasonable, and

- There are no expressely unallowable costs (ie alcohol) in those costs.

Because of the additional administrative burden under the actual method, most contractors prefer the per diem method. Under that method, a traveler does not have to show proof of expenditure, nor incur the expenses, just show that he/she traveled that day, and the purpose of travel. The additional administrative burden is not just on the contractor, but the federal government as well, analyzing costs to ensure the contractor properly segregated allowable and unallowable costs as well as reasonable costs. As such, the US Government also prefers the use of per diem cost reimbursement.

There are two different cost categories under the per diem method of reimbursement. They are:

- Lodging, and

- Meals and Incidentals

Per Diem Resources

GSA Per Diem Website http://www.gsa.gov/portal/content/104877

Per Diem Lookup http://www.defensetravel.dod.mil/site/perdiem.cfm

The following link, http://www.gsa.gov/graphics/ogp/FTR2011-07Complete.pdf, provides a 2004 brochure on the Federal Travel Regulations.

Lodging

Lodging costs are hotel/motel costs for travel where the traveler is on travel overnight.

Meals and Incidentals (MI&E)

Meals and Incidentals are costs for all other travel costs except lodging, and personal automobile costs. Travel days must be considered when reimbursing Meals and Incidental expenses. The first and last day of travel is calculated at 75%.

Additioanal Considerations

If a traveler is attending a conference, a business lunch or dinner, or any other function where a meal is provided, the traveler must not be reimbursed for that meal, and is required to deduct that portion of the daily M&IE attributable to that meal. The GSA provides breakdowns of the various components that make up the daily per diem allowance so that the appropriate costs (lack thereof) can be deducted from the travlers per diem claim. The location of that information is: http://www.gsa.gov/portal/content/101518

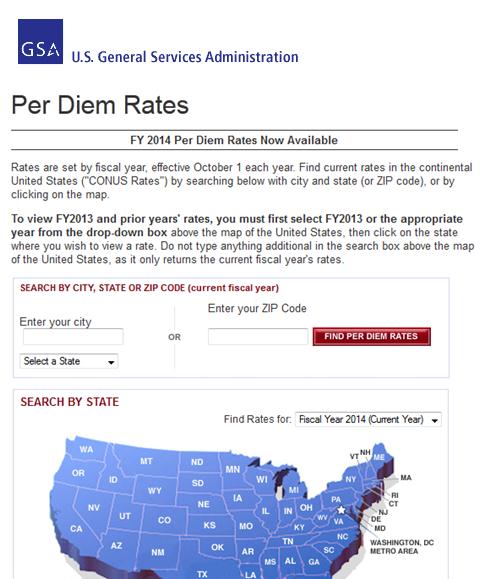

The page where Per Diem Rates can be found on the GSA site [[1]]

Related Topics

For Mileage Reimbursement -- See Privately Owned Vehicle/Mileage Reimbursement Costs