Lodging -300% Rule

Taxes on Excess Per Diem

Lodging taxes are not included in the CONUS per diem rate. The Federal Travel Regulation §301-11.27 states that in CONUS, lodging taxes paid by the federal traveler are reimbursable as a miscellaneous travel expense limited to the taxes on reimbursable lodging costs. For foreign areas, lodging taxes have not been removed from the foreign per diem rates established by the Department of State. Separate claims for lodging taxes incurred in foreign areas not allowed.

300% Rule[1]

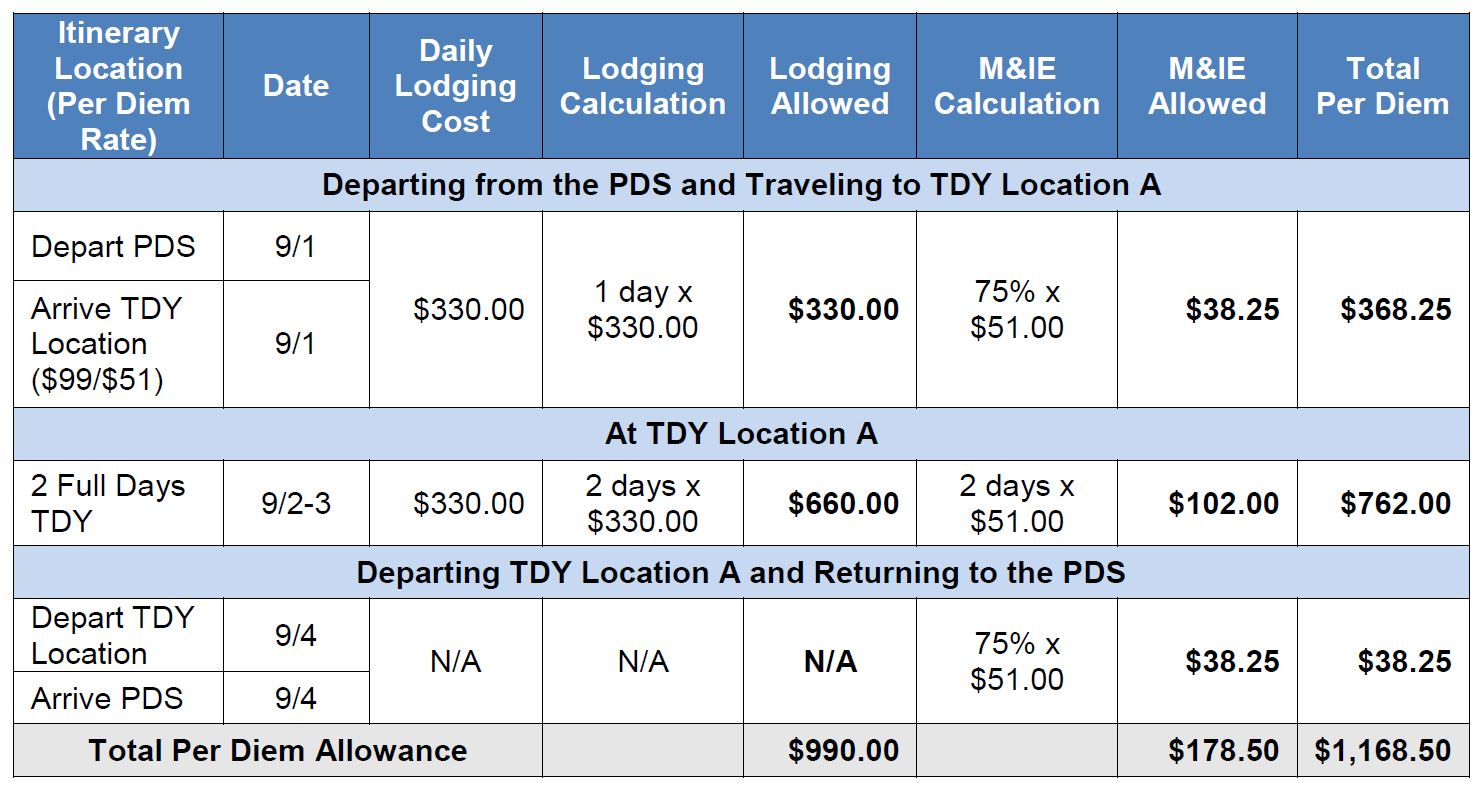

Computing Per Diem with a 300% Actual Expense Allowance (AEA) at a Single TDY Location. AEA Authorized for Lodging and M&IE Paid on a Per Diem Basis (JTR, par. 020307.A)

Note: Rates used in these examples may not be current and are for illustrative purposes only.

Scenario: A traveler is on a TDY at a location where the lodging costs have increased significantly due to a political convention. The AO authorized an AEA of 300 percent for lodging. The locality per diem rate is $150 ($99/$51). The new maximum lodging ceiling is 300 percent of the locality per diem rate, subtracting the M&IE. (300% of $150=$450; $450-$51=$399). The traveler’s actual lodging cost is $330. M&IE is paid on a per diem basis.[2]